February 2021

As January ends and we continue to find ourselves in the middle of a national lockdown there have been a number of announcements relating to business rates affecting businesses across the UK.

The Uniform Business Rate (UBR) for 2021/22

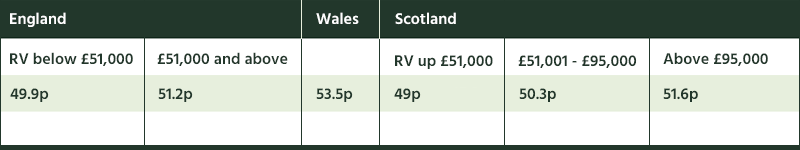

In our update of 27t November we reported the Chancellor’s announcement that the UBR in England for 2021/22 would be frozen at the same level as the current rate year ending on 31st March 2021.

A few weeks later the Welsh Government confirmed that they would take the same step ‘in an attempt to support businesses through the pandemic’ [assuming this is a quote – otherwise probably leave the reasoning out].

In Scotland ratepayers had to wait until the Scottish Budget which was delivered last Thursday which confirmed that UBR for 2021/22 will be reduced to 49p. Properties with rateable value (RV) between £51,001 and £95,000 will continue to pay a 1.3p supplement, and those with RVs above £95,000 will carry a 2.6p supplement.

We have updated our rates liability reports and future estimates to reflect these announcements and the expected UBRs for 2021/22 for the devolved administrations as set out in the table below:

Fundamental Review of Business Rates in England

Freezing the UBR for one year does not go anywhere near addressing the needs of businesses.

In our submissions to the Treasury’s review of business rates we called on Government to implement the following key measures for the 2021/22 rate year:

- Reduce the Uniform Business Rate by 50%

- Continue the existing expanded retail discount (the ‘rates holiday’)

- Remove downwards transitional phasing for all properties that are still impacted by the transitional scheme

We are hopeful that freezing the UBR is not the last word from the Chancellor on business rates measures for the forthcoming year and that he will go further in his Budget on 3 March.

Whilst it had been expected that he would also take that opportunity to announce the outcome of the Fundamental Review, it now seems likely that this will be delayed ‘until the Spring’ which is Government speak for sometime between April and July.

Scottish Budget

In addition to the statement regarding the downwards adjustment to the UBR for 2021/22 there were further announcements in the Scottish Budget which provided some positive news for ratepayers north of the border.

The key ones included:

- A three-month extension to 100% Retail, Hospitality, Leisure and Aviation relief in 2021-22

- Fresh Start Relief threshold increased from RV£65,000 to RV£95,000 to match the Higher Property Rate threshold. This relief encourages the use of empty property by offering 100% relief for up to twelve months to properties that have been empty for six months or more.

- Business Growth Accelerator (BGA) relief will be expanded to property improvements where there has been a concurrent change of use to incentivise the re-use of existing assets.

- Unoccupied new builds will be able to claim BGA relief for up to three years.

Small Scale Hydro Plant and Machinery, the Budget time-limits the current 60% hydro relief and the 50% District heating Relief until 31 March 2032. - For new district heating networks, introduced on or after 1 April 2021 that are powered by renewables, as part of the Heat in Building Strategy, the District Heating Relief will be expanded to offer 90% relief instead of 50%. The 90% relief will be available to 31 March 2024.

- Charitable rates relief will be removed from mainstream independent schools on 1 April 2021 under the Non-Domestic Rates (Scotland) Act 2020.

The extension of the retail hospitality and leisure relief (RHL) scheme for the first three months of 2021/22 is particularly welcome to operators in those sectors. This has been funded from the returned relief already received from some supermarket operators and other larger retailers. The announcement also included a note that should the UK Government bring forward an extension to their equivalent relief scheme that generates consequential funding, Ministers are committed to matching the extension period as part of a tailored package of business support measures. This is a clear challenge to the Chancellor and HM Treasury to listen to the growing demands to continue the rates holiday into next year for ratepayers with limited prospects of being able to operate their businesses in a normal way for some time.

In a follow up message to stakeholders issued over the weekend the Scottish Government have advised the following change to the administration of the RHL scheme:

‘To ensure that this relief only goes to those businesses who require it, we plan to make it application-based in 2021-22. This will be set out in forthcoming subordinate legislation and associated annual non-statutory rates relief guidance.’

Whilst we would agree that it is appropriate to ensure that the relief is not going to essential retailers who have been able to trade well through the pandemic it seems unnecessarily burdensome to put the onus on ratepayers to apply for the relief – as well as likely to create delay and confusion.

Covid Material Changes of Circumstance (MCC) appeals

In our May update we considered the potential for arguing that there are sufficient grounds to pursue MCC challenges in respect of properties that have been impacted by Covid-19 and in particular those that have not benefited from the relief available to occupiers of properties in the retail hospitality and leisure sectors.

The first stage of this process requires a formal “Check” to be made confirming the physical facts of the property and identifying the relevant Covid MCC effect, followed by a formal Challenge identifying the reduction sought and the justification for it.

We have been directly involved in central discussions with the Valuation Office Agency in England and Wales and separately with the Scottish Assessors Association in an effort to reach agreement in principle for the different categories of properties affected, thus potentially avoiding the need to negotiate each property individually. We are hopeful that these discussions will bear fruit and will keep you advised.

Government figures released last week revealed that some 281,690 “checks” have been made in England since April as firms have battled the effects of COVID-19 and have sought to reduce their rates assessments.

Those in the retail, leisure and hospitality sector who have benefitted from the rates holiday have not needed to challenge their RVs thus far but unless the holiday is extended a tsunami of additional appeals will be created by businesses in these sectors.

Grant Schemes

In our update of 22nd October we reported on the introduction of the Local Restriction Support Grants to assist businesses impacted by the introduction of Tiered closures or part lockdowns. Whilst not directly a business rates matter these grants are administered by Local Authorities and awarded according to criteria based on rateable value.

Following the national lockdown introduced from 5th January 2021 the Government in England introduced the Local Restrictions Support Grant (Closed) Addendum: 5 January onwards and the Closed Businesses Lockdown Payment. The Scottish and Welsh Governments have since announced similar schemes.

Links to guidance on the respective schemes are detailed here:

Prior to the end of the transition period on 31st December the grant schemes were subject to EU State Aid Regulations and the State Aid Temporary Framework adopted on 19th March 2020 to support the economy in the context of the coronavirus outbreak. The guidance notes for grants in England make reference to the EU State Aid protocols and state that:

‘The EU State aid rules no longer apply to subsidies granted in the UK following the end of the transition period.’

However the precise position as to amount of aid or subsidy can be claimed from January is unclear from the guidance and we are seeking clarification from BEIS and MHCLG.

We will provide further updates in due course but in the meantime if you have any questions regarding the grant schemes please do not hesitate to contact me or your usual Gerald Eve contact.

Wales Delay Changes to the Empty Rate Regulations

Earlier this month The Welsh Government published a summary of responses to their recent consultation on the draft Non-Domestic Rating (Unoccupied Property) (Wales) (Amendment) Regulations. These brought into effect the proposed change that will require properties to be occupied for a period of six months (instead of the current 42 days) before an owner can claim a further period of empty property rates relief once the property is vacated, after the initial period of three or six months.

The consultation closed on 12 November and many responses referred to the continuing economic circumstances and potential changes in the property markets resulting from Covid-19. It has therefore been agreed that regulations will be laid with a commencement date of 1 April 2022 rather than April 2021. This is intended to allow billing authorities, businesses and other ratepayers time to prepare for the changes to unoccupied property relief.

Some Relief for Airports In England

Finally. the Government issued guidance on Friday for the airport and ground operations funding scheme which had been announced earlier in the year.

The relief capped at £8m for each applicant. The maximum Grant Funding for each Commercial Airport or Ground Handler will be the lowest of the business rates liability for 2020/21, the COVID-19 financial loss or £8 million. Applications must be made by 21st February 2021 just three weeks from publication.

As always we are here to discuss any specific issues regarding your properties and will keep you informed of further development regarding business rates across the UK.

Related Services

Key Contacts

View full teamRelated insights

View all rating updatesCookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |