Rating Update - 2023 Draft Rating Assessments

The draft Scottish Rating Roll was published this Wednesday. While ratepayers in England, where the Chancellor has frozen the UBR multipliers, are now able predict their liabilities from April 2023, those in Scotland and Wales continue to face uncertainty.

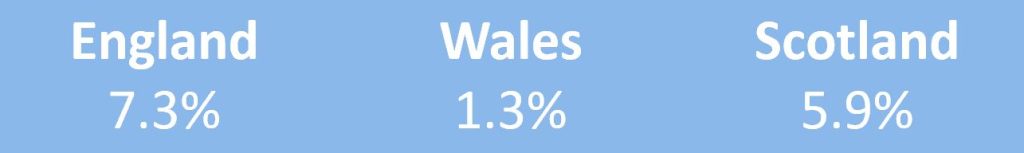

In our Autumn Statement update we set out the measures that the Chancellor announced for England shortly before the publication of the draft 2023 List assessments. With mostly good news for ratepayers in England and Wales, the Autumn Statement delivered much-needed change, but it hasn’t helped everyone. The overall 7.1% rateable value increase across England and Wales hides the massive variance seen regionally and from sector to sector, in some cases increases of over 100%. Our initial analysis of the draft assessments for Scotland shows a similar picture with an overall 5.9% increase masking some significant variations.

More regular revaluation cycles, now moving to three-year cycle, have resulted in valuations being based on more accurate factual data. But the valuation dates used for the 2023 Revaluations mean that the evidential data is more complex and requires careful analysis.

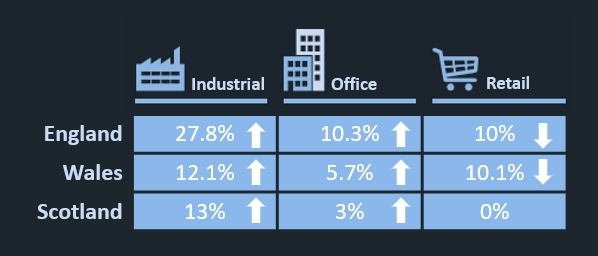

Despite limited transactional activity at the revaluation dates we have seen some wide movements in draft assessments with trends generally being as expected. For the biggest sectors the headline changes are as follows:

The overall statistics don’t reflect the wider movements in certain areas – such as in Scottish retail.

Industrial

Higher than average increases reflect the increased demand and continued rental growth

For the industrial sector in England large distribution has seen average rises of 35.6% while in Scotland the growth is less at 18.1% and 8.2% in Wales.

Rateable Value (RV) growth was not unexpected as a combination of the pandemic, the continued move to online shopping and the delayed impacts of Brexit have seen unprecedented increases in demand for logistics space. With a limited supply this has seen rental levels grow at a huge rate particularly in key distribution hubs.

Retail

General falls reflect the impact of Covid-19 and the general impact on the high street

In Scotland, while we see no change overall, there are drops in retail values that are impacted by regional changes, such as 9% and 11% falls in Edinburgh and Glasgow respectively, and a substantial fall of 40% in Aberdeen for prime retail. There are also examples of growth in the sector with large food stores seeing RV increases of 8.6% in England and 4.9% in Wales while large shops have seen the largest average falls in England and Wales at 36.4% and 34.7% respectively.

Leisure

Similar trend to retail, reflects the impact of Covid-19 on this sector

In a similar picture to retail, the leisure sector has generally seen falls, with hotels seeing drops of 27.7% in England and 15.7% in Wales but growth of 5% in Scotland.

Rateable values for Pubs have fallen by 16.8% in England, 3% in Scotland and 13.5% in Wales.

At the other end of the scale, football stadia have increased by 48% in Scotland and 39.3% in England, compared total fall of 5.7% in Wales.

Offices

More varied with certain locations seeing higher than expected increases

For the office sector there are some significant regional variances with lowest overall changes in England being found in the East Midlands at 5.5% compared to the highest regional change being the Eastern region at 26.3%. In Scotland the variances are similar to retail with increase of 7% and 9% in Glasgow and Edinburgh, but a fall of 15% in Aberdeen.

The total increase for London at just 6.1% may appear surprising but as with all of these statistics there are some significant changes depending on location and from property to property.

These are just a highlight of how varied the changes are. We can provide more details on specific locations and sectors.

At this stage, we are already able to provide clients with updated rate liability forecasts reflecting these figures. For Scotland and Wales, we have had to make assumptions as to the multiplier based on the published assessments and assumptions regarding the impact of inflation. We are hoping that the Scottish and Welsh Governments will follow the Chancellor in freezing their UBRs for 2023 but we are not expecting to learn if this is to be the case in Scotland until the Scottish Budget on 15 December 2022. We expect further announcements on the reliefs at that stage. Empty rates relief policies will be announced by the respective local authorities after that date.

Significant changes coming to the appeal process in Scotland

We have discussed the fundamental changes that the Scottish government has adopted for the 2023 Revaluation.

In addition to a reduction in the time frame for lodging appeals against the Valuation Roll from six months to four months, the new regulations will also require detailed proposals with supporting valuations and evidence to be provided at this stage. This means that ratepayers in Scotland will have to have taken the necessary action by 31 July 2023 or miss the window of opportunity to review their RV.

In effect, this means that ratepayers need to start now on preparing appeals against the 2023 Valuation Roll assessments.

As always, we are here to discuss any specific issues regarding your properties and will keep you informed of further developments regarding business rates across the UK.

Related Sectors & Services

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |