2023 UBR for Scotland confirmed

The Scottish Government has now formally announced that they will also be freezing the multipliers for 2023 in line with the recent announcements in England and Wales.

In the Scottish Budget presented yesterday, it has been confirmed that the UBR multipliers in Scotland for 2023/24 will be frozen at the 2022/23 figures, rather than the anticipated inflation-linked increase, aligning the policy with that in England and Wales.

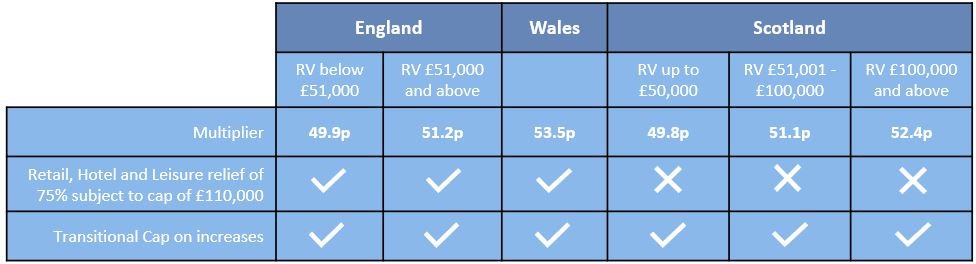

This means that the basic UBR for properties with an RV below £51,000 will remain at 49.8p. Properties with a rateable value of between £51,001 and £100,000 will have UBR of 51.1p and those above £100,000 will pay based on a UBR of 52.4p. The threshold for the large multiplier has increased from £95,000 this year, reducing the number of properties which are liable for the Higher Property Rate.

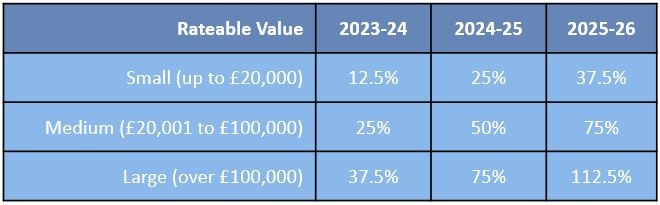

In a further recognition of the policy adopted by Westminster, a transitional relief scheme has also been announced which will limit increases in liability for ratepayers facing increases in their rate bills following the revaluation as follows:

Small Business Bonus Scheme (SBBS)

It has also been confirmed that the Small Business Bonus scheme is being reformed and extended with the Finance Minister confirming that 100,000 properties will continue to pay no rates.

Under the scheme 100% relief will be available for properties with a rateable value of up to £12,000 and the upper rateable value for individual properties to qualify for SBBS relief will be extended from £18,000 to £20,000.

The Scottish Government are tapering the SBBS relief for properties between £12,001 and £20,000: relief will taper from 100% to 25% for properties with rateable values between £12,001 to £15,000; and from 25% to 0% for properties with rateable values between £15,001 to £20,000.

Other Reliefs

The Scottish Government also announced that there will be a scheme to incentivise investment in renewables through the introduction of new prescribed plant and machinery exemptions for onsite renewable energy and storage. The eligibility criteria for reliefs will soon become clear, with specific detail on eligibility in relation to Subsidy Control.

However, it would appear that at this stage the Scottish Government are not planning on extending the reliefs to the retail, hospitality and leisure sectors that have been announced in England and Wales.

New Appeal regulations for Scotland confirmed

On Monday 12 December, legislation was passed by the Scottish Government relating to various legislative timescales and procedures for the 2023 Revaluation.

The published legislation confirms the complete reform of the Non-Domestic Rates system in Scotland, and in particular the new deadline of 31 July 2023 by when appeals against the compiled roll assessments must be submitted.

Certainty across the UK

This means that businesses in the UK can now accurately predict their rate liabilities for 2023/24 – the only exception being those with properties in Northern Ireland where we are expecting announcements early in the New Year.

In summary the multipliers for 2023/24 for England, Scotland and Wales are detailed in the table below:

As soon as more details are released, we will update you.

As always, we are here to discuss any specific issues regarding your properties and will keep you informed of further developments regarding business rates across the UK.

Related Sectors & Services

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |