Autumn Statement 2023: Impact on Business Rates

The Chancellor delivered his Autumn Statement this afternoon with good news for ratepayers of smaller properties and some in the retail, hospitality and leisure sectors but huge disappointment for those with larger properties.

In this update:

- UBR Multipliers for England for 2024/25

- Continued relief for Retail, Hospitality and Leisure

UBR Multipliers for 2024/25

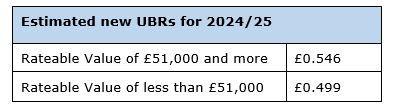

As widely anticipated the Chancellor’s focus this year was very much on supporting small businesses. The announcement that the small multiplier would be frozen again at 49.9p for the 2024/2025 rate year will be good news for businesses in England with properties with a Rateable Value (RV) below £51,000.

However, despite extensive lobbying for a continued freeze for all businesses he confirmed that the large multiplier will be increased by 6.7% from 51.2p to 54.6p.

The change means a sizeable rates increase for 220,000 properties with assessments of RV £51,000 or more. Collectively, these properties contribute more than 75% of total rates revenues and will shoulder the burden of next year’s business rates changes.

These changes apply in England only. The budgets in Wales and Scotland are due in December. It will be interesting to see if the Welsh and Scottish governments choose to freeze, or adjust, their UBR figures in line with England.

Retail Hospitality and Leisure Relief (RHL)

The Chancellor has again acknowledged that the retail, hospitality and leisure sectors have continued to suffer following the impact of the COVID-19 pandemic and the cost-of-living crisis. He has confirmed that the Retail, Hospitality and Leisure Relief scheme will continue in England for the 2024/5 rate year maintaining the discount of 75%. However, this will unfortunately still be capped at £110,000 per business, which means that occupiers of more than a small number of properties will still only see a limited benefit.

As for 2023/2024 we understand that the scheme will continue to be subject to the Minimal Financial Assistance limits under the Subsidy Control Act. This means that no recipient can receive over £315,000 over a 3-year period (consisting of the current financial year and the 2 previous financial years). We expect detailed guidance to be issued to Local Authorities in due course.