Key Highlights of the 2024/25 Draft Scottish Budget

Scottish Budget Announcement

This afternoon the Scottish Government published the Draft Scottish Budget for 24/25.

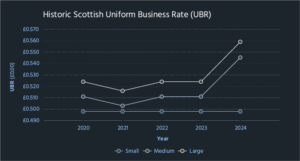

While the small multiplier has been frozen, the medium and large multiplier will increase in line with inflation. This inflationary increase in business rates from next year will be the highest annual rise in more than 20 years and could not come at a worse time for businesses who are trying to recover from the pandemic, economic uncertainty, soaring inflation and the cost-of-living crisis. Scottish large businesses will be paying one of the largest property taxes in the UK. This is counter-initiative to Scottish Government’s intention to create a competitive business and investment landscape in Scotland.

We have summarised the relevant detail below.

Uniform Business Rate (UBR)

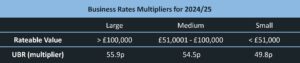

The Scottish Government has formally announced the freezing for the third consecutive year of the basic (small) UBR for 2024/25 at 49.8p, avoiding the inflation-based increase that was predicted.

This aligns with the budget announcement in England, which saw the small multiplier frozen for a fifth consecutive year in the recent Autumn Statement.

Freezing the basic property rate is forecast to save Scottish business approximately £37m compared to the inflationary increase the Scottish Government were entitled to receive.

The last increase of the basic UBR was in the 2022/23 financial year.

The Scottish Government announced maintaining the intermediary rate poundage for properties in the medium-tier band (RVs £51,001 to £100,000) which will receive the full impact of the inflation-based increase to 54.5 p (from 51.1p).

Despite pressure and a manifesto undertaking by the Scottish Government, they have announced that the multiplier for large businesses in Scotland (properties with RVs greater than £100,001) will remain, with those properties impacted receiving the inflationary increase in the UBR to 55.9p (from 52.4p).

This announcement by the Government is the largest single year-on-year increase in the UBR in 20 years.

Reliefs

Small businesses

As a result of the basic rate being frozen, small businesses will continue to pay less in Scotland than the rest of the UK. Furthermore, the Small Business Bonus Scheme (SBBS) relief has been maintained, taking approximately 100,000 properties from payment of rates.

Retail, Hospitality and Leisure Relief

Despite lobbying efforts from hospitality groups for relief measures like those implemented in England and Wales, the Scottish Government has confirmed that relief for the retail, hospitality, or leisure sectors for the upcoming financial year remains unchanged. This lack of further relief measures could pose challenges for these sectors.

Relief has been announced to combat the unique challenges faced by the hospitality industry in Island communities with 100% relief for hospitality subjects in islands communities, capped at £110,000 per business and likely subject to UK subsidy control.

District Heating Relief

The District Heating Relief has been extended until 31 March 2027. This relief has been expanded to include not only new networks, but all district heating networks subject to qualifying criteria.

Enterprise Areas Relief

The Enterprise Areas Relief, currently due to end on 31 March 2024, will be phased out over the next two years. This will offer a transitional period of support for those businesses who have been supported by this relief.

Observations

The discrepancy in business rates continues for big business between Scotland and rest of UK.

Businesses in Scotland are facing a higher financial burden in comparison to their counterparts in other parts of the UK. This discrepancy is a crucial factor for businesses operating in Scotland to consider. This highlights a significant policy lever that could be used to support Scottish businesses.

There are over 11,600 properties that will continue to pay the ‘large business supplement’ of 55.9p. This accounts for approximately 64% of the total value within the valuation roll.

The devil will be in the detail as usual, and we await the release of legislation over the coming weeks. We will closely monitor these developments and will continue to provide you with pertinent updates and advice to help navigate these changes effectively.

Contact us

Please do not hesitate to contact us if you have any queries. We are here to discuss any specific issues regarding your properties and will keep you informed of further news on the business rates front.

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |