Minerals and Waste Business Rates Update

Will you pay too much, or too little, for your business rates?

1 April 2023 is a key date for your business rates liabilities. It closes the ability to challenge your 2017 rating value (and the amount you’ve paid or possibly overpaid). It is also the date you start to pay rates based on the 2023 Rating List. As a result of Revaluation 2023, there are significant increases in the rates due to be paid on minerals and waste management facilities. And not all will be accurate.

What’s happened across the minerals and waste sector.

Since the 2015 valuation date there have been significant increases in both rental values and construction costs. The valuation date used for the 2023 Revaluation is set against a backdrop of uncertain and economically turbulent times.

In the minerals and waste sectors;

- rental increases on certain types of property, especially in some major cities, have shown particularly substantial increases

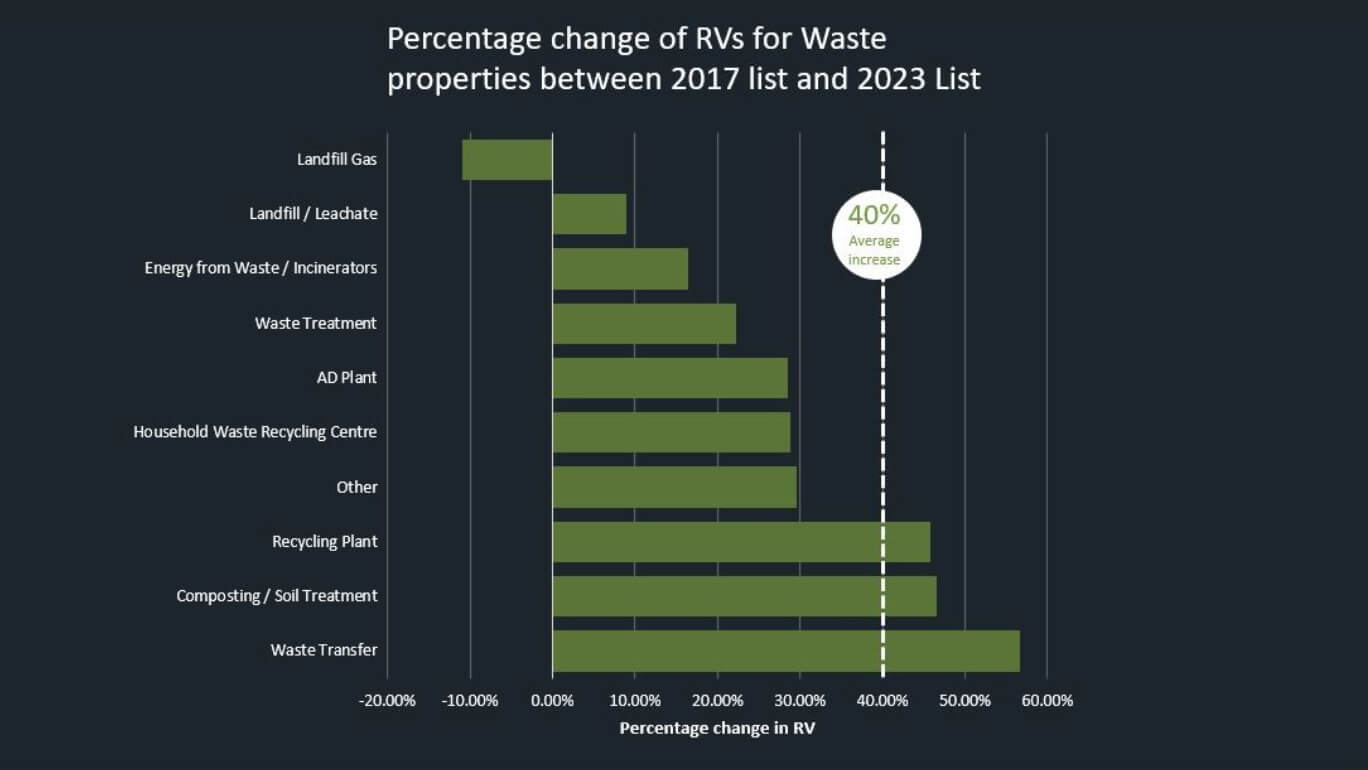

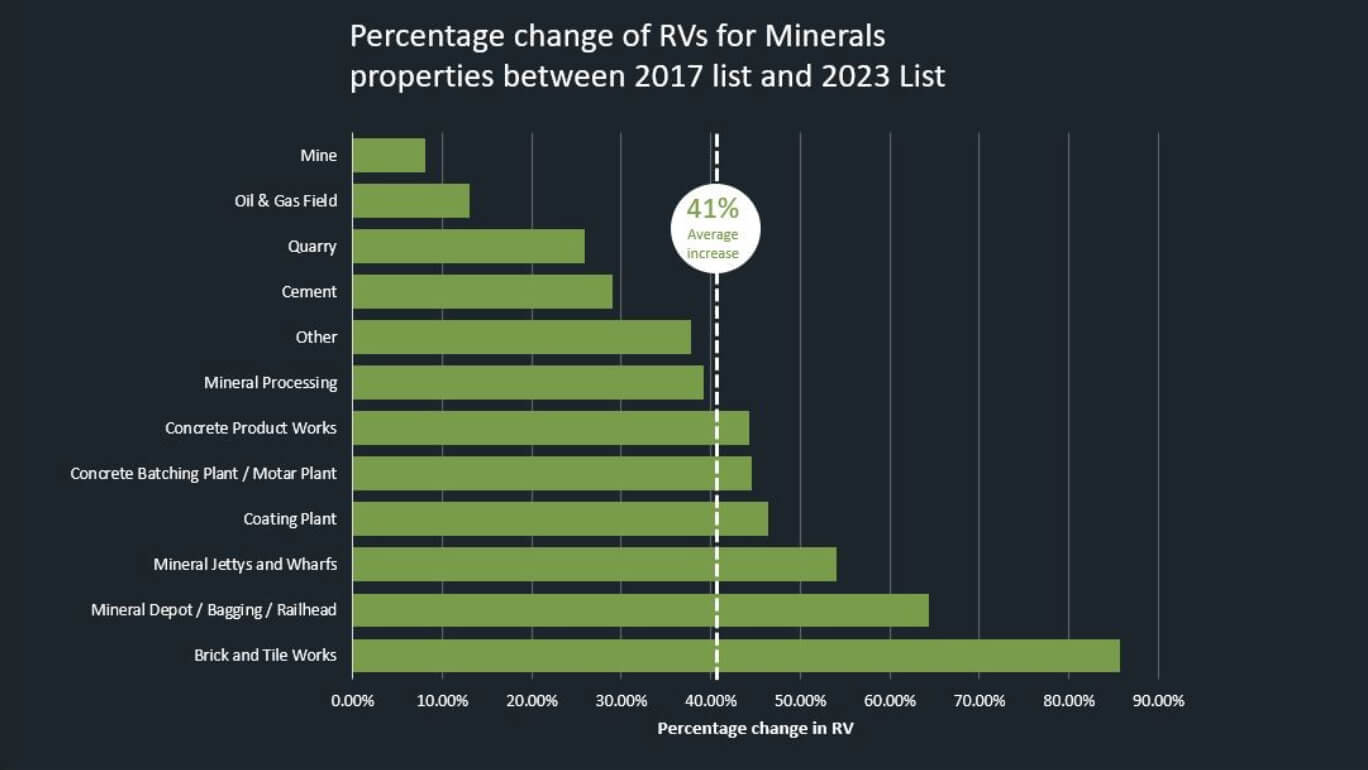

- on average rates assessments have increased by approximately 40%, with some individual property assessments increasing by more than 150%

- some property types have risen on average by as much as 86%

Here are the average increases across various property types:

Revaluation 2023 – why it’s important to check your new Rateable Value.

Ratepayers in England, Scotland and Wales are all now able predict their liabilities effective from 1 April 2023. However, it is critical that you are aware of how your business rates assessments and bills are calculated to ensure you are being assessed on a fair basis, and that you are receiving the maximum benefit from potential relief schemes.

Factors effecting your RV and business rates liability:

- Your 2023 Rateable Value (RV) is derived from an exceptional economic period encompassing Brexit, Covid, Cost of Living Crisis and Energy Crisis.

- Valuation Officers and Assessors have not been able to undertake detailed analysis for each individual property assessment – some general assumptions have been applied to your assessment from limited, commercially sensitive cost and rental evidence.

- There can be specific reliefs, schemes and grants available to properties in the minerals and waste sector that most operators will not be aware of.

- England, Wales and Scotland now have different multipliers, reliefs, schemes and appeals systems and timeframes.

- You might have a chance to pre agree a revised RV before 1 April 2023, or risk not having an outcome on your appeal for up to two years.

- 31 March 2023 is the final deadline to submit an appeal for your business rates bills for 2017; 2017 values are used as a factual base point for Revaluation 2023.

- Any underassessed values from the 2017 or 2023 rating list might be corrected by the Valuation Office, presenting you with an unforeseen bill you might not have accrued for.

For more information on Revaluation 2023 read our guide.

Prepare now for 1 April 2023.

As the business rates burden on operators and tenants is already substantial and these changes come at a time of economic shifts and property value changes, we want to ensure the minerals and waste sector is fully prepared for Revaluation 2023.

Using our detailed market research and our bespoke business rates forecasting system Gerald Eve is currently helping clients accurately and efficiently forecast and budget for their rate liabilities on the 2023 List. Talk to one of the team about your rate liabilities forecast.

Has a Rating Expert reviewed your 2017 RV?

There is now a very limited time to challenge the 2017 Rating List assessments, with a deadline of 31 March 2023 to submit your application and evidence. However, it is important to review your 2017 RV, not only for a potential rebate but to ensure the value used for 2017 is accurate.

Business rates paid under the current 2017 Rating Revaluation are based upon rental values as at the valuation date of 1 April 2015. Some of your 2017 assessments could be erroneous for many reasons, such as an unjustified rental estimate, or assessment of buildings, plant, or machinery that is no longer present.

The process to assess and prepare appeals needs to be started now to meet the deadline on 31 March 2023. Talk to one of the team today about what would be required and the timeframes for your specific property portfolio.

Talk to one of our minerals and waste business rates specialists.

Our specialist Minerals and Waste team is working with a variety of clients, ranging from Aggregate Industries, Breedon, and Tarmac to independent smaller operators, ensuring the business rates they pay are accurate and manageable. We are here to provide certainty for budgeting and forecasting, to look for potential savings, as well as to minimize any risk and ensure compliance. Get in touch to find out how we can help you.

Related Sectors & Services

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |