Rating Update - Spring Budget 2023

The Chancellor delivered his Spring Budget yesterday afternoon, and as we had anticipated, there was very little mention of business rates in the headlines, given that he had announced major changes in last year's Autumn Statement. Nonetheless, several important updates have been published alongside the written statement that have important implications for ratepayers. We outline these below and expect to be able to provide more detail in the coming months.

The Chancellor’s speech in the House of Commons only mentioned business rates in passing in the context of the incentive package for the proposed Investment Zones and in connection with the continued policy to move towards a 100% business rates retention model for certain local authorities. The accompanying written statement trailed four publications relating to business rates, the first three of which were published yesterday afternoon. They precede a Non-Domestic Rating Bill which we expect to be laid in Parliament shortly, intended to provide for three-yearly revaluations from 2026, together with associated measures.

Business rates technical consultation: summary of responses and Non-Domestic Rating Information and Impact Note (NDRIIN) publication

Full paper: Business Rates Technical Consultation: Summary of Responses >

This first publication is the long-awaited response to the technical consultation carried out at the end of 2021 which followed on from the review of the business rates system originally launched in March 2020. The consultation set out the Government’s proposed package of measures which it believed were required to move to a more regular three-yearly revaluation cycle and introduced the concept of the Duty to Inform for ratepayers, alongside improved transparency from the Valuation Office Agency (VOA), further reform to the appeal process and various other measures.

Duty to Inform

The consultation document introduced a proposed new duty for ratepayers to inform the VOA of any changes to the occupier and property characteristics that affect the assessment of their properties for business rates. This included rent/tenure changes, occupation changes, and physical alterations. While the principle of this requirement is not unreasonable, the timeframes proposed were considered to be unrealistic. We, along with others, raised concerns around the ability of the VOA systems to cope and the significant new obligations that would be placed on ratepayers.

The Government claims to have listened to concerns and has announced the following:

The proposed 30-day deadline for information provision will be extended to 60 days

Annual confirmation returns will be required

A compliance and penalty regime will impose fines for failure to provide and higher penalties for false information

“Exempt” properties will be excluded unless a change brings them into scope although at this stage it is not clear what is meant by “exempt” and how a ratepayer will know if their change takes them into scope!

The Government intends to bring this duty in during the life of the 2023 Rating List, but acknowledges that this system should be easy for ratepayers to navigate and suggests that penalties will only be used as a last resort.

The proposal is that the system will be subject to a soft launch and will only come into full operation once the VOA systems have been developed to facilitate it.

Appeal Reform

The consultation proposed reform to the appeal process which the Government has confirmed as follows:

Check stage will be dropped from the Check Challenge Appeal (CCA) process alongside the 2026 revaluation and once the new duty to inform is in place.

This is a sensible measure which will hopefully speed up the appeal process. The Check will become unnecessary once the Duty to Inform requires ratepayers to notify physical changes to their properties within a 60-day timeframe.

The proposal for a three month Challenge window from 2026 is extended from three months to six months but will be under constant review with a view to reverting to three months from 2029.

This change would bring the system in England closer in line with the new system to be introduced in Scotland from April 2023. We have major concerns around the ability of ratepayers to review and provide the detailed information and evidence required at the Challenge stage in such a short timeframe. In our responses to the consultation, we expressed the view that any restrictions on the ability to challenge would need to be accompanied with genuine transparency from the VOA in terms of the evidence upon which their assessments are based.

Improvement Relief

Confirmation that the introduction of 12 months of relief for qualifying improvements to be delayed until April 2024.

The consultation proposed a new relief to be introduced from April 2023 where occupiers of properties make qualifying improvements. The intention is now for this relief to be introduced from 2024 and we await further detail regarding the qualification criteria.

Other Administrative Changes

There were a number of additional administration changes within the consultation that the Government has confirmed will now be brought forward including:

Discretionary Relief – a change to allow Local Authorities to apply discretionary relief granted under s47 retrospectively from April 2024.

This is a welcome change although we believe that more fundamental reform to reliefs and exemptions is required.

Material Changes of Circumstances – a change to ensure that changes in legislation, licencing regimes and guidance will not be considered a legitimate ground for a material change of circumstances appeal.

This reflects Government policy following on from the legislative measures that were taken during the Covid-19 pandemic which removed the ability to argue that any Coronavirus related matter was grounds for an MCC appeal. We do not support this change.

Valuation Office Agency’s Business Rates: Transparency and Disclosure consultation publication

Full paper: Consultation on Disclosure Sharing Information on Business Rate Valuations >

The response to the Technical Consultation referenced the move by the Government to improve transparency. The VOA has already completed the first stage of this which delivers what they consider to be improvements to the current way in which information is displayed. This consultation covers the second stage of transparency with proposals as to how much and in what way evidence can be shared with ratepayers earlier in the process. Our initial view is that the measures set out in the consultation do not go anywhere near far enough in allowing proper transparency. The consultation requires responses by 7 June 2023. We will be responding to this directly and contributing to the responses of the professional bodies and trade organisations. We also welcome your views and would be happy to assist you if you’d like to make your own response – send us an email.

Digitalising Business Rates (DBR): Connecting business rates and tax data

Full paper: Digitalising Business Rates >

This is a relatively short response to the consultation held last year by HM Treasury concerning the digitisation of business rates and linking business rates information to a business’s wider tax data. The document and proposals sit alongside the new Duty to Inform and at this stage, it is very vague as to when this will come into effect. The document states that the Government will legislate for DBR when parliamentary business allows and references that the previously published roadmap gives an indicative date for the launch of 2026 to 2027.

As we have previously indicated these proposals put yet more obligations on ratepayers with little obvious benefit. One of the potential positive aspects of DBR was the opportunity for central billing to replace individual demands from Local Authorities. This had potential benefits for those businesses occupying multiple sites and many will be disappointed that this aspect has been removed from the scope.

Business Rates Avoidance & Evasion Consultation

This is the fourth consultation document identified in the Budget statement. Local authorities have long been concerned that businesses are avoiding liability – especially empty property rates – in ways that they consider inappropriate, and Government intends to consider the issues and options. This consultation has yet to be published and follows changes already implemented in Wales and Scotland. As soon as the document becomes available, we will update you further.

Revaluation 2023

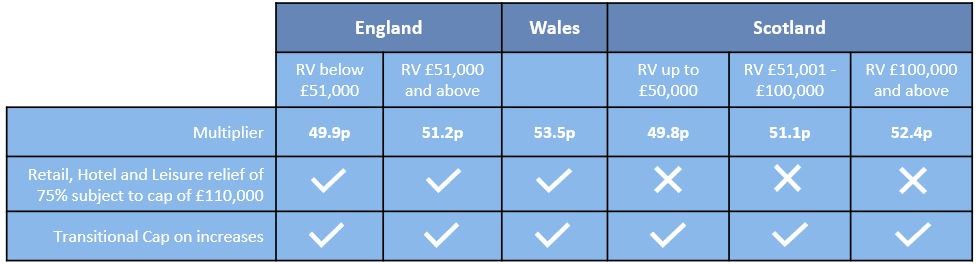

The 2023 Revaluation becomes live on 1 April 2023 and local authorities are now issuing rate demands for 2023/24 which reflect the frozen UBRs across the country which can be summarised as follows:

This information is always available on our data card along with helpful summaries of the transitional arrangements schemes and reliefs applicable in each of the countries.

Refunds

Finally, there is some good news for those who will be due refunds for overpayments during the 2023/24 rate year. The regulations direct that local authorities should pay interest on refunds resulting from rating list amendments at a rate of 1% below the Bank of England base rate. Due to the low levels of interest rates in recent years, there has been no interest payable since 2009, however, for refunds issued from April 2023 there will be an interest element calculated at 3%. The calculation of interest for a specific refund is complex and this is something that our Rates Payment Management Team (RPMS) can review to ensure that the regulations are correctly applied.

As always, we are here to discuss any specific issues regarding your properties and will keep you informed of further developments regarding business rates across the UK.

Related Sectors & Services

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |