Impact of Revaluation 2023 on retail and restaurants

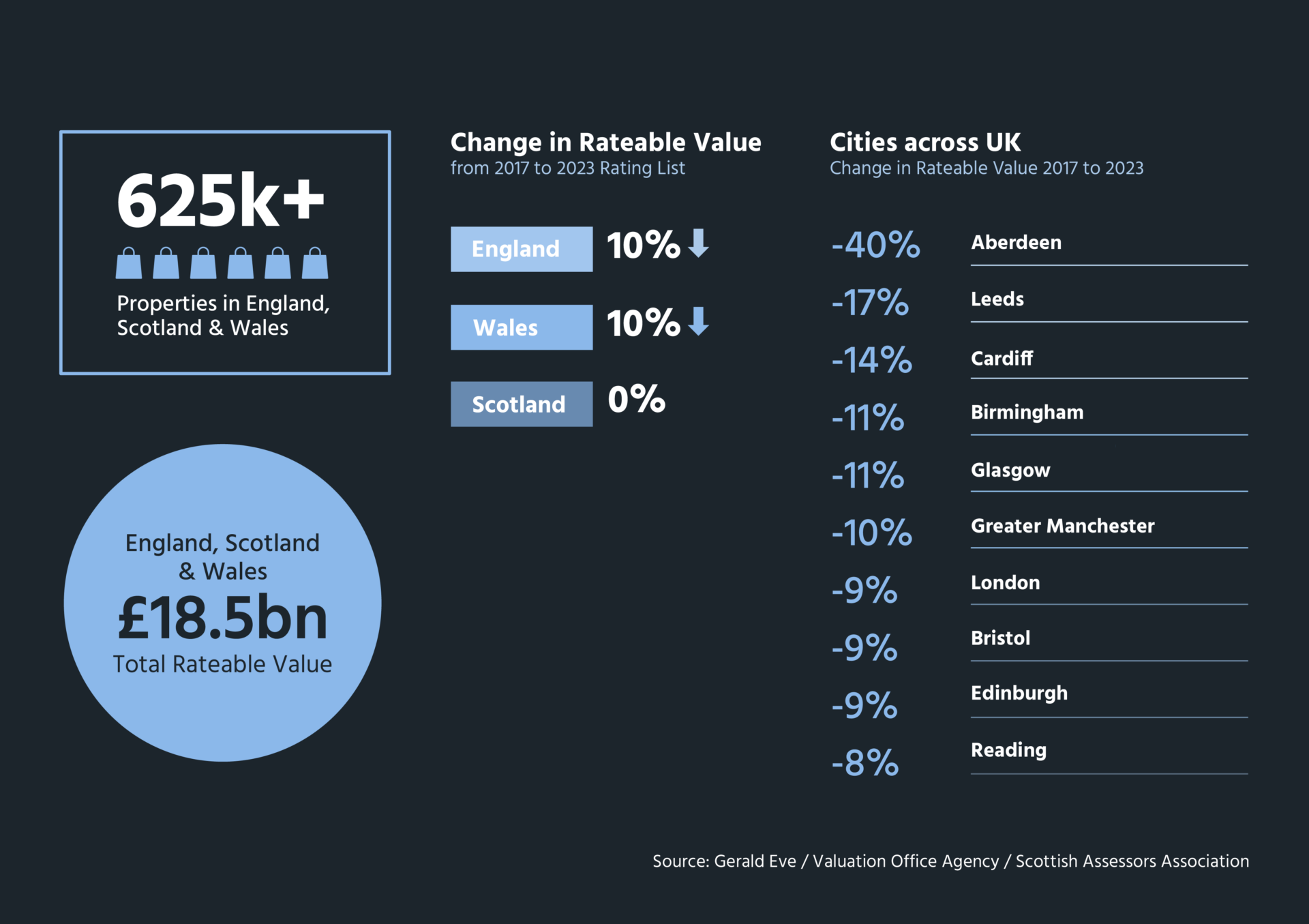

The retail and restaurant sectors have seen many challenges in recent years, but have they been fairly reflected in Reval 2023? These sectors as a whole have benefitted from a 10% reduction in total Rateable Value, but this figure disguises huge variations in value change by region, location and specific use. The total Rateable Value for retail in England has fallen by 10%, but there was no change in Scotland. English convenience store values have risen by 35%, but values for department stores have dropped by 45%. Our analysis of regional and sector variabilities underscores the importance of taking proactive steps to ensure the accuracy of property valuations. By doing so, retail and restaurant operators can better position themselves to navigate the current market.