Rating Update – Spring Budget 2024

7 March 2024

Spring Budget 2024

The Chancellor delivered his Spring Budget yesterday afternoon with little direct reference to business rates. While not included in his speech at the dispatch box, the Government has now published its conclusions on the recent consultation on rates avoidance and evasion and announced a change that aims to make it more difficult for businesses to avoid empty rate liabilities.

In this update:

- Changes to the Empty Rate Regulations

- Relief for Retail, Hospitality and Leisure reconfirmed

- Relief for film studios

- Rate demands for 2024/25

Changes to the Empty Rate Regulations

Following the consultation on business rates avoidance and evasion, which concluded in September 2023, the Government has now published its findings. It has also announced that the period for which a property needs to be occupied before a business can claim empty rates relief will be increased from six weeks to 13 weeks with effect from 1 April 2024. There are no changes to the periods of 100% rate relief available, which remain at three months (or six months for qualifying industrial properties).

When the current empty rates rules were last changed in 2008, removing 100% relief for empty factories and warehouses and removing the 50% relief granted after a short period of full exemption following vacation for other property types, the justification was that this would encourage landlords to bring vacant properties onto the market and lower their rent expectations.

We questioned this at the time, but in the current economic climate, where in many cases stock exceeds demand, landlords have no reason to hold back vacant properties from the market. The three-month rates-free period (six months for factories and warehouses) is not sufficient to find a new tenant, let alone upgrade and repurpose older properties to attract new businesses.

As part of the latest consultation response, the Government has announced yet another consultation, this time on a “General Anti Avoidance Rule” for businesses in England with the aim of addressing other forms of rates avoidance and evasion. We will update you further when this is published.

Retail Hospitality and Leisure Relief (RHL)

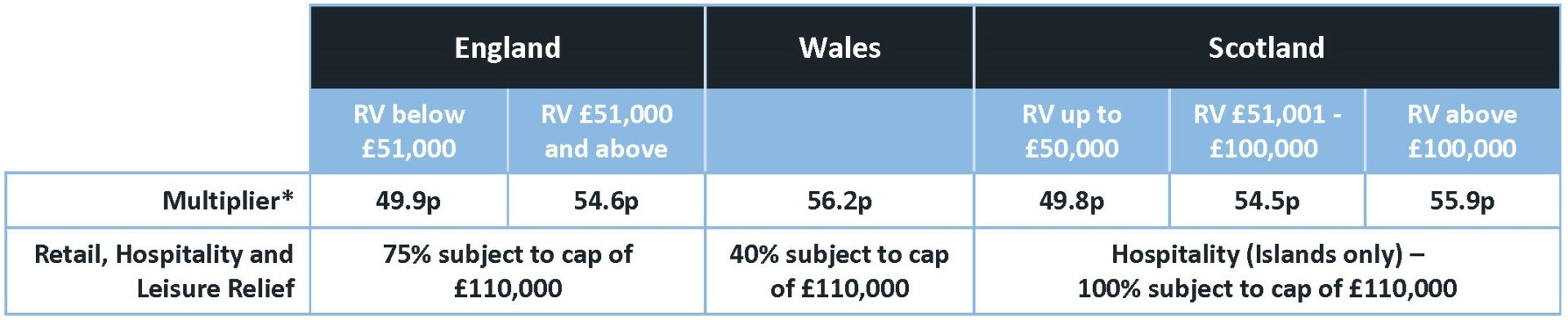

In the Autumn Statement, the Chancellor acknowledged that the retail, hospitality and leisure sectors have continued to suffer following the impact of the COVID-19 pandemic and the cost-of-living crisis. Yesterday, he took the opportunity to remind ratepayers that the RHL Relief scheme will continue in England for the 2024/5 rate year, maintaining the discount of 75% capped at £110,000 per business.

In December, The Welsh Government followed by announcing that RHL will continue in Wales for 2024/25 but at a reduced discount of 40%, also capped at £110,000 per business, while in Scotland, there will be a limited hospitality relief scheme for Islands locations only at 100%, again subject to a cap of £110,000 per business.

We understand these schemes will continue to be subject to the Minimal Financial Assistance limits under the Subsidy Control Act. This means that no recipient can receive more than £315,000 over three years (consisting of the current financial year and the two previous financial years). Guidance has been issued to local authorities in England. Read more here >

Relief for Film Studios

As part of a support package for the creative sector, the Chancellor announced that the Government would provide eligible film studios in England with 40% relief on their gross business rates until 2034. As a group, film studios faced the largest rateable value increases at the 2023 Revaluation. Together with the industry, we have been seeking lower assessments and lobbying for Government support. We are awaiting further details regarding eligibility criteria and how the relief will be calculated.

Rate Demands for 2024/25

Local authorities throughout the UK are currently distributing the 2024/25 rate demands, and businesses should expect to receive them shortly.

Even though the Consumer Price Index (CPI) indicates a decrease in inflation to 4% — with a further reduction to 2% anticipated later this year by the Government — the significant 6.7% increase in the large Uniform Business Rate (UBR) in England, tied to the CPI, stands firm.

To help you navigate this landscape, we’ve compiled the key details in the table below:

For a comprehensive view of all Uniform Business Rates, reliefs, and transitional arrangements, explore our business rates data card.

Many ratepayers are facing unprecedented increases in their liabilities, particularly those with significant rateable values increases since the 2017 Rating List and diminishing transitional scheme benefits. We are actively working with clients to review assessments and explore avenues for challenges.

If you’re grappling with these increases or have concerns about your business rates, don’t navigate this alone. Contact us for expert support and guidance on how to manage and potentially mitigate your business rate liabilities.

As always, we are here to discuss any specific issues regarding your properties, and we will continue to keep you informed of further developments regarding business rates across the UK.

BUSINESS RATES DATA CARD

FIND OUT THE LATEST UBRCookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |