Changing property valuations

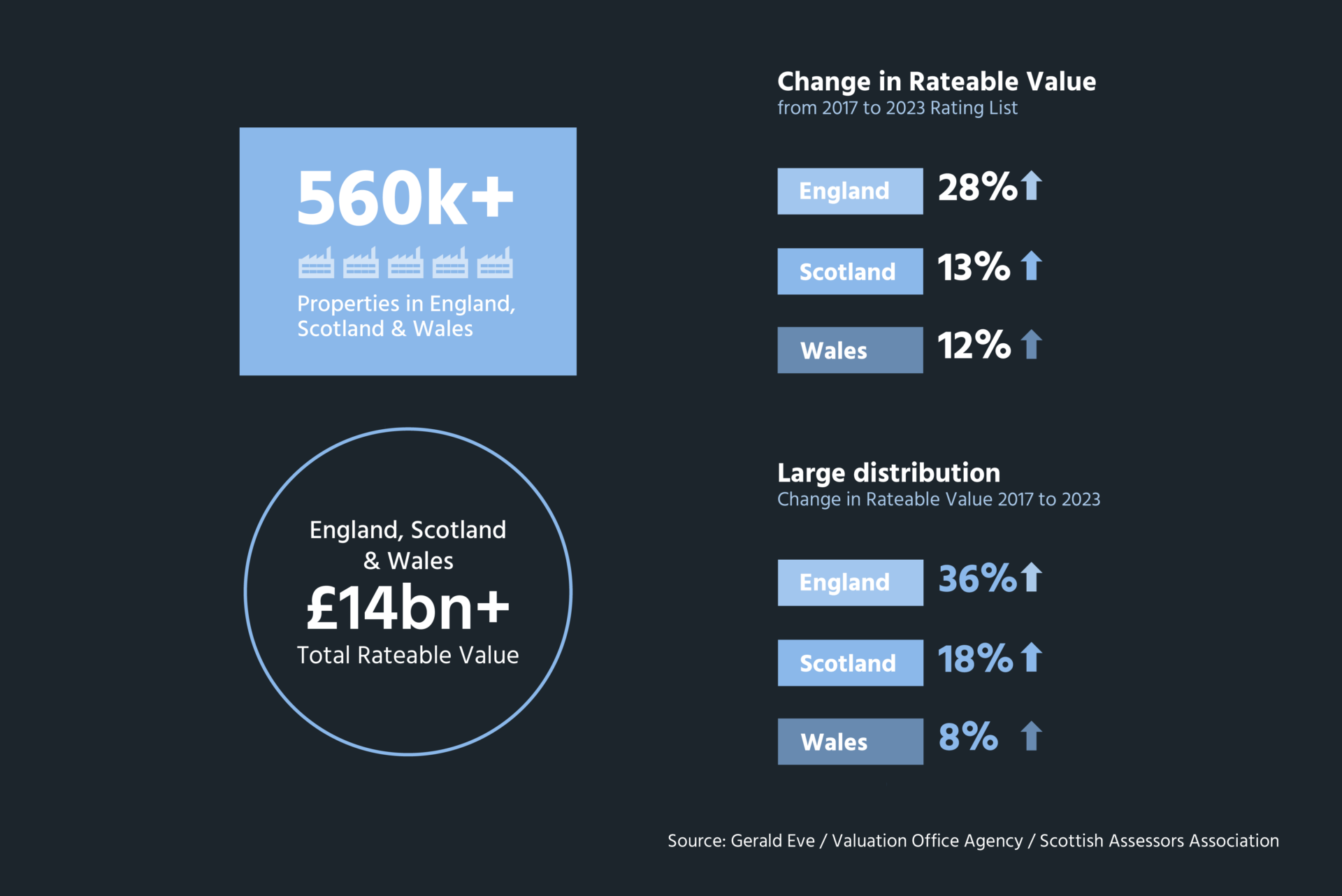

This sector has demonstrated resilience throughout the pandemic with continued rental growth due to higher occupier demand resulting from the move to online retailing, the delayed impact of Brexit and a limited supply of industrial accommodation.

This growth has been particularly strong in the distribution sector and has filtered through to more traditional industrial occupiers. Increases in rental values, especially those agreed close to 1 April 2021 (the valuation date for the 2023 Revaluation in England and Wales), directly impact ratepayer liabilities, leading to higher costs for industrial and logistics occupiers.

However, not all properties should see such significant Rateable Value increases. As rental growth in parts of the sector continued after April 2021, there is a risk that the Valuation Office Agency may have placed too much weight on potentially inflated evidence and, therefore, overvalued assessments.

In England and Wales, Rateable Values can be challenged through the Check, Challenge, Appeal process.

Regulatory compliance

England and Wales

Non-Domestic Rating Act 2023

The Non-Domestic Rating Act 2023 will introduce potentially onerous mandatory obligations on ratepayers to regularly update the tenure and physical details of all properties within their portfolios with the Valuations Office Agency (VOA).

Increasing the administrative burden on businesses, it will require prompt updates to the VOA and annual returns even where there are no changes, with penalty risks for non-compliance. The complexity of business rates management will increase with measures anticipated to be fully in place for the 2026 Revaluation.

Material Change of Circumstance (MCC)

Legislative changes to Material Change of Circumstance provisions took immediate effect in October 2023. They tighten the scope of MCCs in England so that new legislation, licensing regimes and guidance from public bodies will not be grounds for a change in Rateable Value between revaluations.

Completion Notices

For buildings that have been temporarily removed from the rating list during redevelopment, billing authorities will be able to issue Completion Notices in the same way as for a new building. The regulatory changes should be in effect from January 2024.

Scotland

Since January 2023, Scotland’s new legislation has transferred Valuation Appeals to the Scottish Courts Tribunal service. This entails strict deadlines and rigorous requirements for ratepayers and advisors. All appeals against valuations from April 2023 should have been submitted as a comprehensive case with supporting data by 31 August 2023. Learn more about how to appeal business rates in Scotland >