IMPACT OF CORONAVIRUS ON THE UK I&L MARKET

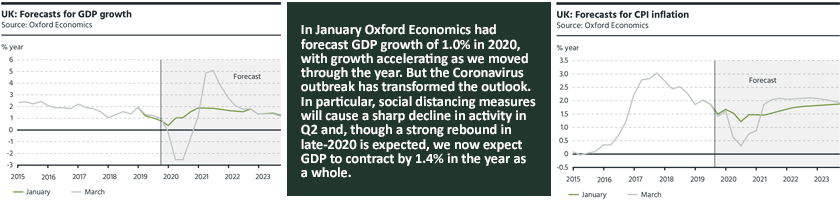

The global economy is entering a deep recession and the nearterm outlook is extremely challenging. In the UK, the introduction of measures to restrict movement to try to slow the spread of Coronavirus will cause significant disruption to activity in the short term and 2020 UK GDP forecasts have been slashed to -1.4% from +1% only a month ago. There is huge uncertainty around the duration and impact of current measures and a further worsening of the outbreak and financial stress could see GDP fall by 2.5% this year. Supply chains are under enormous pressure to maintain adequate inventory levels and cope with wild fluctuations in demand.

Like all commercial property sectors, there is an expectation that industrial and logistics tenant defaults will increase through 2020 as cashflows are impacted, but this will also depend heavily on government intervention and the nature of industrial occupier activities.

While all occupiers will experience short term impact, the scale and duration will vary greatly across industries.

Many tenants are struggling with cost pressures and are already requesting monthly payment plans or rent payment holidays, and these are being looked at on a case-by-case basis to assess genuine need. Industrial and logistics occupiers have not benefitted from the recently announced relaxation of business rates liabilities and other tax credits, with the 12-month business rates suspension currently only for retail and leisure sectors.

We have been lobbying to expand this business rates discount to all properties.

What has been the impact so far on individual industrial and logistics occupier sectors?

Demand for logistics space is derived from the supply chains of goods that flow through them. In the short term this mostly will not change as many are tied to basic daily needs such as food and beverages, consumer necessities and medical supplies.

Indeed, in the immediate term, demand for some of these products and services has sharply risen as households increase spending to stockpile whilst also social distancing and home working.

Even some e-commerce specialists are unable to offer delivery slots for weeks, suggesting huge demand is really stretching delivery network capacity. Consequently retailers and manufacturers of food are looking at restricting their product lines that are offered to streamline production and logistics.

A step change increase in this activity across all generations of society could be one of the main structural changes to emerge from this crisis. Also the relaxation of rules relating to overnight deliveries has been an effective measure. Whilst emergency in nature some elements of these temporary legal changes could prove structural if shown to work.

In contrast, transportation and storage of raw materials and intermediate goods from abroad, notably Asia, have been disrupted. Over the medium term, more discretionary domestic consumer spending will be held back as incomes fall and precautionary saving rises in response to the recession.

Food and groceries are not required by restaurants but in very high consumer demand, with the likes of Sainsburys, Morrisons and Co Op among others changing staffing, recruitment and delivery patterns to meet the surge. But food preparation for sale in cafes, bars and restaurants will suffer a significant short term drop in demand and activity. The wider impact on food production is not yet clear, but there could be potential labour shortages for seasonal peaks if movement of people remains restricted for longer periods.

The airfreight industry could see a seismic change as capacity is likely to be lost, some of which is unlikely to return in the short to medium term. . Those who survive will potentially have a far larger share of the market, but that market will be smaller, at least initially.

Trade counter operators are the largest individual occupier group in multi-let industrial, and, consumer demand for these types of products has notably increased in the short term, which will be offset to some extent by fewer small building companies operating. Large swathes of workers required to work from home means that residential, landscaping and DIY activities will provide some of the only opportunities to spend time and money. The more restrictive household lockdown brought in on the 23rd March will have a significant impact, however, the trade counter distribution capacities are likely to be insufficient for demand. This also relies on the supply of goods being available where elements are produced or manufactured in affected areas abroad.

In this same regard, UK manufacturers are vulnerable to factory closures around the world since they rely upon parts manufactured off-shore and assembled on-shore, which the automotive sector has illustrated. Carmakers are dusting off plans drawn up to cope with Brexit to help their businesses during the wave of factory shutdowns because of Coronavirus. They have restored emergency measures, including letting warehouses to stockpile parts, as they prepare for weeks of plant downtime while still accommodating shipments of goods.

The call to certain manufacturers to repurpose some outputs to produce greater numbers of ventilators to help deal with the crisis will not be sufficient to change overall UK manufacturing in any material way, since our view is that only a limited number of business could successfully retool quickly to meet this requirement in the short term. The more high tech engineers involved in pharmaceutical, medicine and biotech are more insulated in the short term for obvious reasons and this could also potentially lead to greater space requirements over the medium term as Coronavirus testing kits and/or vaccines are produced in large numbers.

Small on-site automotive and off-site construction sectors are likely to see some of the lowest levels of employees and firms adhering to the social distancing policy since many are small independent businesses and/or working towards fixed cost projects. Also automotive and building repair is, in some contexts, an essential requirement. Consequently, these occupiers could be relatively less affected, notwithstanding the broader impacts of a deep recession, which could particularly impact the self-employed in in the absence of any state aid.

Leisure operators occupying industrial space, such as wellness, amusement, recreation and childcare will be impacted significantly as many are discretionary spend or involve congregating in groups. This has been a growing segment in multi-let but still represents a relatively small proportion of the total in the order of low single digits of percentage of all occupied industrial space.

The fast-growing quasi-office segment of multi-let that includes archiving, data centres and some closer approximations of more traditional office use, such as management consultancy, finance and real estate, are likely to be relatively insulated. Data centres and archives are crucial components of business operations and relatively sparsely occupied with employees. Other more traditional uses involve employees more able to work remotely and continue business operations.

The impact so far on UK industrial and logistics capital markets

The past two weeks have seen a marked change in risk appetite among some investors, with a renewed focus on covenant risk as occupiers’ cashflows are impacted by the spread of Coronavirus. There is a real likelihood of tenant default among those tenants who were already struggling through end-2019 and early in Q1 2020.

Generally, there will be a more cautious approach to underwriting and void assumptions but these are only a best guess at present. We know many investors with assets under offer are returning to investment committee to stress-test previous assumptions before proceeding.

Sales in solicitors’ hands will take longer – search results, remote working and obtaining necessary signatures will all take that bit longer. Meanwhile, most planned sales will be put on ice for the time being where vendors are selling through choice rather than necessity. Access arrangements will make inspections and surveys very challenging for the next few weeks or even months. But, some investors are taking advantage of this period to prepare assets for sale when signs of normalisation return – we just do not know how long that will be.

While investor demand has narrowed overall, it does still remain for high quality or rare assets with particular attributes. An example of this is Perivale Park in north west London, which had 10 or so competitive bids last week, and we have first-hand experience of other deals being agreed within the last 7 days, illustrating both vendor and purchaser conviction, albeit in a relatively small number of examples. Blackstone, last week, completed the purchase of a £120m portfolio of logistics assets from Clearbell, another firm sign that activity does still remain, but overall transaction volumes look set for a low year.

For now, real estate still provides attractive return fundamentals relative to bonds and equities. For example, the gap between gilt yields and prime logistics equivalent yields is close to 400bps at present, but this is obviously very volatile. To give this some context, in 2008, pre-GFC, the yield gap was c.100bps.

Sterling’s depreciation will bring global capital to the UK, which was already looking very strong, so we expect this to continue to be the case once the effects of the Coronavirus start to fade.

Current construction projects are being impacted in terms of the supply of materials and labour, and it seems inevitable that delays will occur to timescales. Developers are committed to seeing through projects already underway, but are hamstrung by restrictions on movements, and, are pausing on starting new projects.

What impact are we seeing on the UK lending market?

Most lenders have advised that they remain open for business at this difficult time, although also report of several operational difficulties. Not least, dealing with two Bank Rate cuts in the space of a matter of weeks has meant that many financial instruments had to be changed, and then changed again.

The MPC reduced the Bank Rate every month for 6 consecutive months between October 2008 and March 2009, but the speed of the current cuts has proved challenging.

Several lenders are also re-deploying staff from real estate teams to work on the new debt products which will be supported by the recently announced government guarantees. This is a large-scale government initiative which is likely to continue to channel resources away from real estate lending in order to help with the practical interpretation of the schemes.

Lending for existing developments continues, although construction drawdowns have been delayed by the impact of social distancing on site access for monitoring surveyors. Lenders are more sceptical of new development opportunities as current market conditions mean build terms are extended and sales take longer, which will impact development returns. Some lenders have stated they are stress testing new enquiries by adding between 3-6 months to the build programme.

Transaction volumes are also expected to slow considerably in 2020, despite the low cost of debt. Real estate investors are likely to price in diminished future income expectations, which will limit the volume of transactions, and lenders are struggling to price assets against a backdrop of interest rate volatility.

Whilst the upcoming quarter date will likely see borrowers cover their bank liabilities, as the market and country remain on lock down, we may see some borrowers failing and defaulting on or around the June quarter date if market conditions do not improve.

There is a strong case for a debt service deferral to be provided across the board, and the industry is looking at ways to protect landlords whose businesses have been hit by rental holidays, as they won’t have the income to pay lenders.

Related Service and Sectors

Cookie Policy

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |